Palau Chamber Of Commerce - Truths

Wiki Article

The 30-Second Trick For Palau Chamber Of Commerce

Table of ContentsFascination About Palau Chamber Of CommercePalau Chamber Of Commerce - The FactsThe Buzz on Palau Chamber Of CommerceThe Greatest Guide To Palau Chamber Of CommerceThe Main Principles Of Palau Chamber Of Commerce Little Known Questions About Palau Chamber Of Commerce.Not known Facts About Palau Chamber Of CommerceMore About Palau Chamber Of Commerce

To find out more, take a look at our short article that speaks more in-depth about the main nonprofit funding resources. 9. 7 Crowdfunding Crowdfunding has actually turned into one of the important means to fundraise in 2021. Therefore, not-for-profit crowdfunding is ordering the eyeballs nowadays. It can be utilized for certain programs within the organization or a general donation to the reason.Throughout this step, you may desire to think of milestones that will show an opportunity to scale your not-for-profit. When you have actually operated awhile, it's crucial to take some time to think of concrete development goals. If you haven't currently created them during your preparation, produce a set of key performance indications and also turning points for your nonprofit.

What Does Palau Chamber Of Commerce Do?

Resources on Starting a Nonprofit in different states in the US: Beginning a Not-for-profit FAQs 1. Just how much does it cost to begin a nonprofit organization?

Not known Facts About Palau Chamber Of Commerce

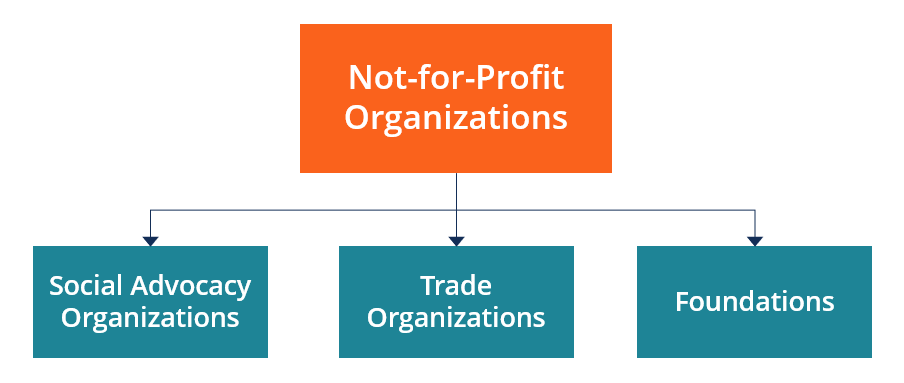

With the 1023-EZ form, the handling time is commonly 2-3 weeks. 4. Can you be an LLC and a nonprofit? LLC can exist as a not-for-profit minimal liability business, however, it ought to be totally possessed by a solitary tax-exempt nonprofit organization. Thee LLC must additionally fulfill the requirements as per the IRS required for Minimal Responsibility Firms as Exempt Organization Update.What is the difference in between a structure and also a not-for-profit? Structures are commonly moneyed by a family members or a business entity, but nonprofits are funded through their revenues and fundraising. Foundations generally take the cash they started with, spend it, and after that distribute the cash made from those investments.

Palau Chamber Of Commerce Fundamentals Explained

Whereas, the money a not-for-profit makes are utilized as running expenses to fund the company's mission. This isn't necessarily true in the situation of a foundation. 6. Is it tough to start a nonprofit organization? A nonprofit is a service, yet beginning it can be rather extreme, needing time, clearness, and cash.There are several steps to start a nonprofit, the obstacles to access are relatively few. Do nonprofits pay tax obligations? If your not-for-profit makes any kind of earnings from unconnected tasks, it will certainly owe earnings tax obligations on that quantity.

About Palau Chamber Of Commerce

By far the most common type of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax obligation code that accredits such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, academic, or scientific.

Some Known Incorrect Statements About Palau Chamber Of Commerce

The lower line is that exclusive structures get much even worse tax obligation treatment than public charities. The primary difference in between personal foundations check this and public charities is where they obtain their monetary support. A private structure is commonly regulated by a private, family, or corporation, and also acquires a lot of its revenue from a few donors and also financial investments-- an example is the Expense and Melinda Gates Structure.

The Definitive Guide for Palau Chamber Of Commerce

This is why the tax obligation legislation is so challenging on them. Many structures just provide cash to other nonprofits. However, somecalled "running structures"operate their own programs. As a functional matter, you require at the very least $1 million to start an exclusive structure; otherwise, it's not worth the problem and cost. It's not shocking, after that, that a private foundation has actually been referred to as a large body of money bordered by individuals that want some of it.Other nonprofits are not so lucky. The IRS at first assumes that they are exclusive structures. However, a new 501(c)( 3) organization will be categorized as a public charity (not a personal structure) when it obtains tax-exempt standing visit this page if it can reveal that it sensibly can be anticipated to be openly sustained.

The Only Guide to Palau Chamber Of Commerce

If the internal revenue service categorizes the nonprofit as a public charity, it maintains this condition for its first five years, no matter of the public support it in fact gets during pop over to these guys this moment. Palau Chamber of Commerce. Beginning with the nonprofit's 6th tax obligation year, it needs to show that it fulfills the public assistance examination, which is based on the support it obtains during the current year as well as previous four years.If a nonprofit passes the examination, the internal revenue service will certainly proceed to monitor its public charity condition after the initial five years by calling for that a completed Set up A be filed each year. Palau Chamber of Commerce. Discover out more regarding your nonprofit's tax standing with Nolo's book, Every Nonprofit's Tax obligation Guide.

Report this wiki page